Now that the presidential election is over, you may have questions about how the results could impact borrowing for dental school and repayment after you graduate, including loan forgiveness. While too early to tell, there are several proposals to keep on your radar based on what has been said and written about possible changes to borrowing, repayment, and forgiveness. So, let’s begin:

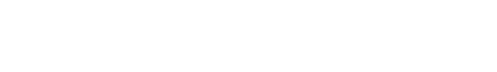

Changes to what you can borrow

There is a proposal to eliminate federal loans, such as the federal direct unsubsidized and federal direct PLUS (Grad PLUS), the two loans most often used by dental students to pay for dental school. In other words, federal loans would no longer be an option for borrowing for any higher education program. The proposal states that if federal loans are not completely eliminated, then an annual limit would be placed on federal loans, one that is likely well below what many dental students need to cover their cost of attendance. This means you could end up with all private loans or a mix of federal and private loans when you graduate, all of which have different terms and conditions, making repayment and keeping track of your loans more challenging.

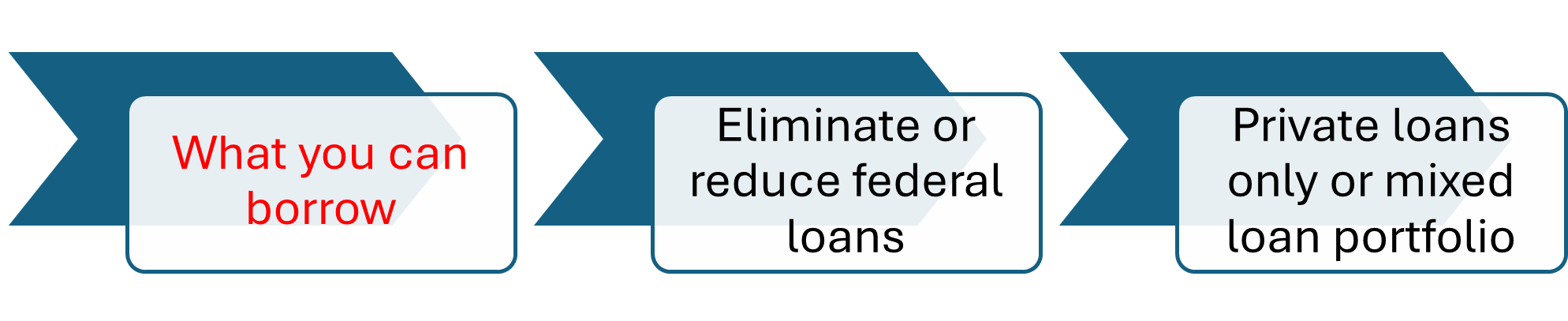

Changes to how you repay your loans

There is a consideration on the elimination of income-driven repayment plans like SAVE. This is the most recent repayment plan with the lowest monthly payments and an interest benefit where the government covers all the monthly interest not covered by the minimum payment. This plan keeps a borrower’s debt from growing when they cannot cover the interest due each month. This means that if you need an income plan with affordable payments, it is likely to be an older plan where the government does not help cover any interest your minimum payment does not cover, putting you in a position of having to decide whether or not to be aggressive on repayment of your student loans, and if so, how aggressive. It could also have other financial implications related to how much you put into retirement, savings, and home ownership.

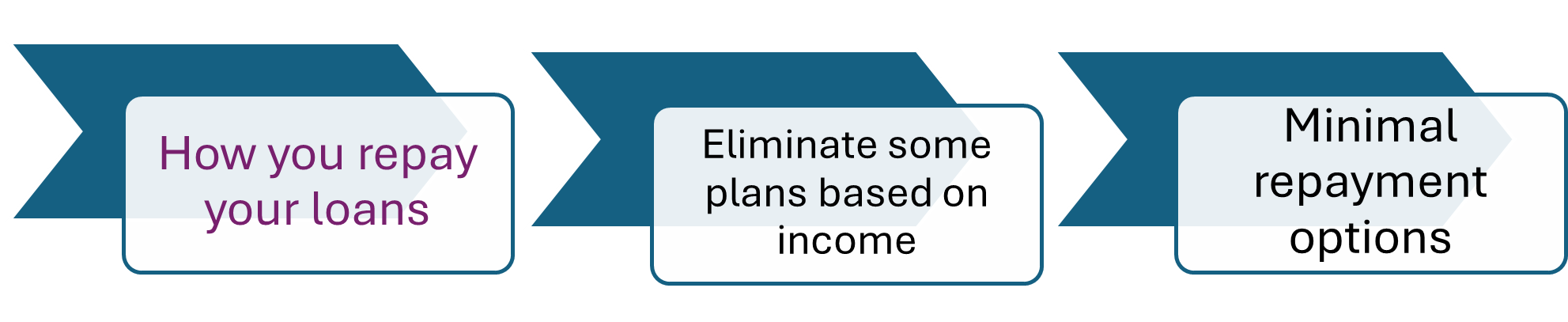

Changes to loan forgiveness

In consideration is the elimination of the Public Service Loan Forgiveness (PSLF) program where borrowers who have worked in the public non-profit sector for 10 years can have their remaining loan balance forgiven. While the majority of dental school graduates work in the for-profit sector and do not take advantage of PSLF, having access to PSLF could be extremely helpful if you have high student loan debt and become interested in working in a community-based non-profit dental clinic; academic dentistry; a county, state, or federal entity; or in some other non-profit organization where your income potential may not be as high as the for-profit sector.

There are a number of sources for information on student borrowing and student debt, however, don’t forget your first point of contact when thinking about paying for dental school should always be your school’s financial aid office. They will have updates on proposed changes and can help ensure you know what kind of financial aid is available, deadlines for grants and scholarships, and when you can apply, including when to complete the FAFSA (Free Application for Federal Student Aid). Remember, it is up to you to stay abreast of changes related to financial aid to ensure you can make the best decision for your current or future career as a dental professional.